The decentralized finance (DeFi) ecosystem has been one of the most remarkable trends in the digital asset space, evolving rapidly over the past few years. Polkadot, a multi-chain network that promotes interoperability and scalability, has emerged as a significant player in this expansive landscape. This article delves into the growth of DeFi on Polkadot, examining its expansion, technological edge, user engagement, and what the future holds for this blossoming sector.

DeFi on Polkadot: A Rising Force

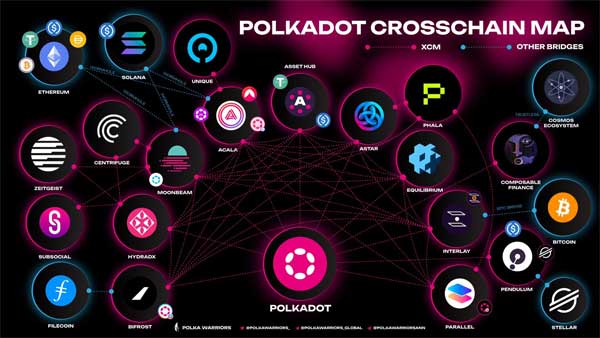

Polkadot’s unique value proposition lies in its ability to connect various blockchains through its relay chain architecture, allowing for unprecedented interoperability and scalability. DeFi protocols have begun leveraging these features to create a more fluid and integrated landscape that extends beyond the limitations of existing networks. A rising number of projects on Polkadot’s ecosystem have contributed to positioning it as a formidable force in the DeFi arena. From stablecoins to lending platforms, the diversity of DeFi on Polkadot rivals that of established chains, setting the stage for further innovation and growth.

Analyzing Polkadot’s DeFi Expansion

The expansion of DeFi on Polkadot has been marked by:

- An influx of new projects leveraging Polkadot’s substrate technology.

- Increased volume and liquidity across various DeFi platforms running on the Polkadot network.

- Strengthening of the development community dedicated to enhancing Polkadot’s DeFi capabilities.

These expansion metrics underscore the network’s rising popularity and the trust developers and investors are placing in the Polkadot ecosystem. Along with the growth in functionalities like cross-chain composability, the Polkadot DeFi scene has showcased robust growth in the breadth and depth of services offered to users.

Interoperability: Polkadot’s Ace Card

Interoperability is not just a feature of Polkadot; it is its cornerstone. By facilitating interoperability between different blockchains, Polkadot allows DeFi protocols to communicate and transact with one another seamlessly. This promotes a level of fluidity unseen in the DeFi ecosystems of more isolated chains. Polkadot’s use of parachains – specialized blockchains tailored to specific use cases – further strengthens its DeFi ecosystem by facilitating niche applications and services that contribute to a holistic DeFi environment. Polkadot’s architecture has set a standard for the future of interoperable DeFi protocols.

Polkadot’s DeFi: Users & Transactions

User adoption and the number of transactions are vital gauges of success for DeFi platforms. Polkadot’s DeFi ecosystem has seen a steady increase in both:

- The user base has grown, thanks in part to the simplification of cross-chain transactions.

- The transaction volume has surged, indicating a heightened level of activity and liquidity in the DeFi applications on Polkadot.

Community incentives like yield farming and governance tokens have also played a role in boosting user interaction and commitment to the ecosystem. By fostering a vibrant community around its DeFi offerings, Polkadot ensures continuous engagement and feedback, driving further innovation.

Future Trends in Polkadot’s DeFi Space

Observing the recent developments, several trends can be anticipated for the future of Polkadot’s DeFi space:

- Greater integration with other blockchain ecosystems to enhance cross-chain DeFi applications.

- The emergence of more sophisticated financial instruments and decentralized autonomous organizations (DAOs).

- Rising interest from institutional investors seeking exposure to innovative DeFi projects on Polkadot.

Further innovation in developer tooling and user interfaces will likely make Polkadot’s DeFi applications more accessible to a broader audience. As the ecosystem matures, we can expect stronger emphasis on security and sustainable economic models within Polkadot DeFi.

DeFi Growth: Polkadot’s Road Ahead

The road ahead for Polkadot’s DeFi ecosystem is paved with both challenges and opportunities. As the network scales, it will face the ongoing challenge of maintaining security without compromising the speed and interoperability that make it appealing. Polkadot’s community is expected to continue growing, complemented by more initiatives focusing on education, usability, and regulatory compliance. Sustainability of DeFi projects will become a significant focus, as well as the importance of user-centered design practices to increase mainstream adoption.

The continuously evolving nature of the DeFi sector means that Polkadot must remain agile and responsive to industry shifts. Considering these aspects, Polkadot’s contributions to the world of DeFi appear to hold promising prospects for reshaping financial services on a global scale.

Polkadot’s DeFi Ecosystem – A Comparison:

| Feature | Polkadot DeFi | Other DeFi Networks |

|---|---|---|

| Interoperability | High | Variable |

| Scalability | High with parachains | Dependent on Layer 2 solutions or sharding |

| Inclusivity of projects | Broad, with a focus on niche solutions | Typically more general |

| Community and Development Support | Robust | Highly variable |

| Security | Strong, with shared security across parachains | Can be variable, dependent on individual network’s measures |

| User Experience | Developing, with growing emphasis on ease of use | Ranges from beginner-friendly to complex |

Polkadot’s DeFi ecosystem represents the forefront of innovation in decentralized finance. With an architecture designed for interoperability and scalability, it is well-positioned to accelerate the evolution of financial services and embrace future trends. As developers continue to build and refine on Polkadot, and as users demand more from their financial experiences, the network stands ready to address these needs and shape the DeFi landscape of tomorrow. The growth of DeFi on Polkadot is not just an exciting development; it is a harbinger of the transformational power of blockchain technology in creating a truly open and interconnected financial world.

Interoperability sounds good but is it really safe? I worry about security.

User base and transactions are increasing in Polkadot’s DeFi. Good to know!

I think other networks are better for DeFi. Polkadot is overrated.

I learned that Polkadot’s DeFi has strong scalability with parachains.

Polkadot could be great, but what about the regulatory issues?

Security and ease of use are important. Polkadot is focusing on these for DeFi.

I’m not convinced Polkadot can handle the security and scalability issues.

Too many technical words! Can someone explain in simple terms?

I didn’t know about parachains. They make Polkadot’s DeFi strong.

The future of Polkadot’s DeFi seems promising with more integration and innovation.

Polkadot is growing fast in DeFi. I like its focus on interoperability.

I don’t understand how Polkadot works. It seems very complicated.

The article explains well how Polkadot connects blockchains!

Polkadot’s community and development support are really robust.

Why is Polkadot better than other networks? I don’t see the difference.

How can Polkadot improve user experience? It still seems hard to use.